By Charlee Borg

COVID-19 has impacted the anti-trafficking community in many ways. Nonprofits closed their doors, some pausing 24/7 services for the first time, conferences were canceled, and those lucky enough to keep their jobs may have moved to remote client support methods. Some people in labor trafficking situations were further removed from help-seeking opportunities due to increased demand on essential workers and decreased community mobility after quarantine recommendations swept the country.

Survivors with histories of labor trafficking and countless people facing economic, food, and housing instability were put at risk for exploitative work situations as businesses closed, families lost their jobs, and essential items were hard to come by. For Black, Brown, indigenous, Asian, foreign national, and LGBTQIA+ individuals, this was further compounded by a year of structural prejudice, violence, and collective trauma. The pandemic weighed heavy on us all but heaviest for those at risk for, or seeking stability from, their labor trafficking experiences.

This is why it is imperative that before May 17, anti-trafficking advocates help connect clients to financial support through the IRS’s stimulus check system.

I don’t know anything about tax information, isn’t there someone better I should refer to?

Helping clients navigate the IRS and tax systems is like assisting them in setting up doctor appointments, preparing for court hearings, or speaking to skills on job applications. Most often, the things clients need the most help with are system navigation, clarification, and distress tolerance. Our clients often have many things going on in their lives each day that take from their energy pools. For some, this may be coupled with experiences of fear, scarcity mindset, imposter syndrome, and unfamiliarity. Your ability to offer energy-saving support may be essential to accessing these crucial resources. There is also help available. Call 211 or visit the “Low Income Taxpayer Advocate” page to locate free tax resources in your community!

What are the stimulus checks?

The “Economic Impact Payments,” AKA stimulus checks, are a form of economic relief passed by Congress. The first COVID-19 relief executed in April 2020 provided $1,200 for individuals with an additional $500 per eligible child dependent. The second payment of $600 offered households an additional $600 per eligible individual and qualifying dependent. These checks were issued by January of 2021. Recently, the third approved stimulus check for $1,400 per eligible individual and another $1,400 for each dependent (including adult dependents) was issued in March 2021.

The “Economic Impact Payments,” AKA stimulus checks, are a form of economic relief passed by Congress. The first COVID-19 relief executed in April 2020 provided $1,200 for individuals with an additional $500 per eligible child dependent. The second payment of $600 offered households an additional $600 per eligible individual and qualifying dependent. These checks were issued by January of 2021. Recently, the third approved stimulus check for $1,400 per eligible individual and another $1,400 for each dependent (including adult dependents) was issued in March 2021.

How much are the stimulus checks?

Check 1 from April 2020: $1,200 plus $500 per dependent under 17.

Check 2 from January 2021: $600 plus $600 per eligible dependent.

Check 3 after March 2021: $1,400 plus $1,400 per eligible dependent.

Typical total for individuals making less than $75K a year: $3,200

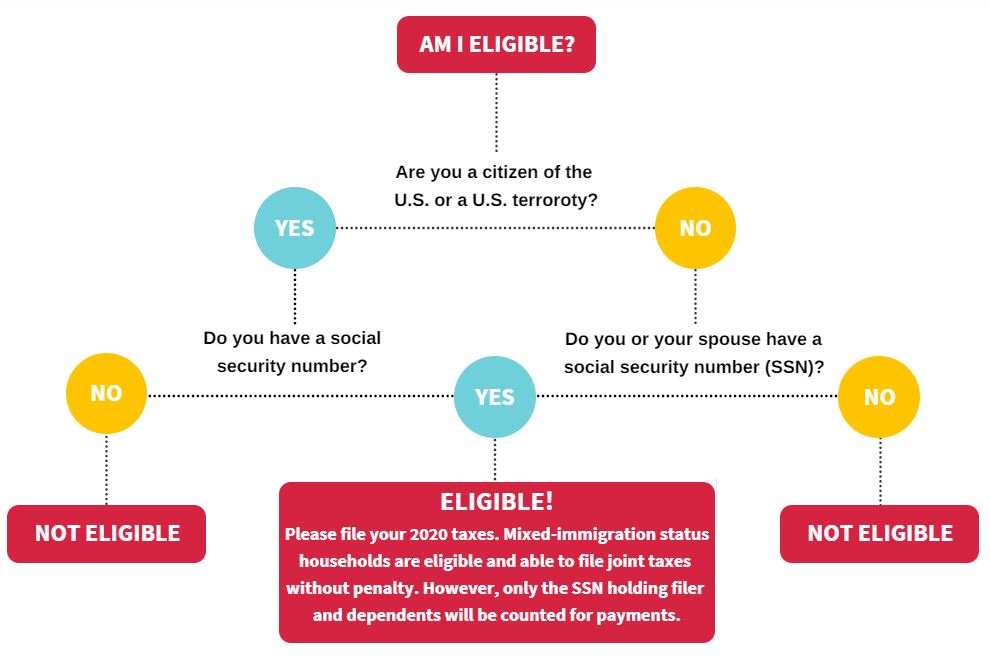

How do I know if my client is eligible for the third stimulus check?

How do I help my client claim their third stimulus check?

The easiest and quickest way to get your stimulus check is to file your 2020 tax return with an accessible address and connecting a direct deposit option through the 2020 return. Free online filers and personalized services are available online or by calling and asking 211. Low-cost and free checking accounts can also be set up online or with your local banks.

How do I help my client claim their past checks?

When your client files their 2020 taxes, they will be able to claim their past checks as a Recovery Rebate Credit (on Line 30 of Form 1040). If your client filed their 2020 taxes but did not use this option, they must file an amended return. Past stimulus checks can be accessed retroactively and paid through bank accounts, prepaid cards, and checks. Direct deposit is the quickest way to receive payments if your client is interested. Help set up a free checking account online, or connect with banks in your community to assess viable options.

Someone took my client’s 2021 stimulus check.

Parent: If your client was incorrectly claimed as a dependent on their parent or guardian’s 2020 taxes, they can submit a “Recovery Rebate Credit” claim. When submitting, the National Nonprofit for Youth recommends attaching a detailed explanation with information of the incorrect dependent claim and the guardians’ name to the return. To find out if your client is viewed as a dependent in the eyes of the IRS, review pages 25-35 of the IRS Publication 17.

Partner: If your taxes were filed without your consent, you can file a “Recovery Rebate Credit” claim. Once the IRS responds, you will have 60-days to respond to the IRS decision letter and explain your situation. During this process, you may be able to receive free legal consultation from a Low Income Taxpayer Clinic.

Someone Else Deposited My Check: If someone deposited your check after it arrived, you can request a payment trace by phone or mail-in form. To learn more about when to report a check stolen, read this article.

Additional Resources for Special Populations:

•People Experiencing Incarceration

•Taxpayers with Limited English Proficiency

The IRS offers services in English, Spanish, Simplified Chinese, Traditional Chinese, Korean, Russian, Vietnamese, and Haitian Creole. Contact 211 or local tax services in your community to find additional language resources.

•Income Information for Households and Individuals

•Domestic Violence Victims and Survivors

•Information for Mixed Immigration Status Families

•Blended Family Households with Dependents

•Individuals Not Required to File Tax Returns

Still have questions on the third stimulus check? See frequently asked questions answered by DC Legal Aid Society.

References:

- School House Connection & National Network for Youth. How You Can Support Youth Experiencing Homelessness to Access Funds. https://files.constantcontact.com/28254e99301/1c4166c1-856a-4066-bc28-005620a3df3a.pdf

- National Network to End Domestic Violence & Center for Taxpayer Rights, The Community Tax Law Project. Did Your Spouse or Ex-Spouse Take Your COVID Economic Impact Payment in 2020? https://nnedv.org/wp-content/uploads/2021/03/DV-and-Stimulus-Payments-Flyer-3.16.21.pdf

- Underwood, J. (2021, March 18). Here’s Who is Eligible for the Third Stimulus Checks https://www.forbes.com/advisor/personal-finance/who-is-eligible-for-the-third-stimulus-check/#:~:text=According%20to%20the%20American%20Rescue,an%20AGI%20up%20to%20%24150%2C000

- Dolcourt, J. (2021, April 23). Stimulus Checks: Plus-up Payments, IRS Delivery Timeline, Everything Else You Should Know. CNET. https://www.cnet.com/personal-finance/stimulus-checks-plus-up-payments-irs-delivery-timeline-everything-else-you-should-know/